The largest global community in Financial Services

Over half a million users

On the platform

More than 1,000 institutions

Served by Symphony

8/10 asset managers

largest global by AUM

10/10 investment banks

largest global by revenue

SOLUTIONS

Find efficiency and innovation

Utilize Symphony to connect and liquefy financial transaction workflows

Embedded Collaboration

Respond to clients and counterparties within existing applications and platforms

Voice Solutions

Eliminate communication silos and enable instant voice connectivity

Compliant Messaging

Securely meet clients on their preferred channel, such as WhatsApp, WeChat & text messaging

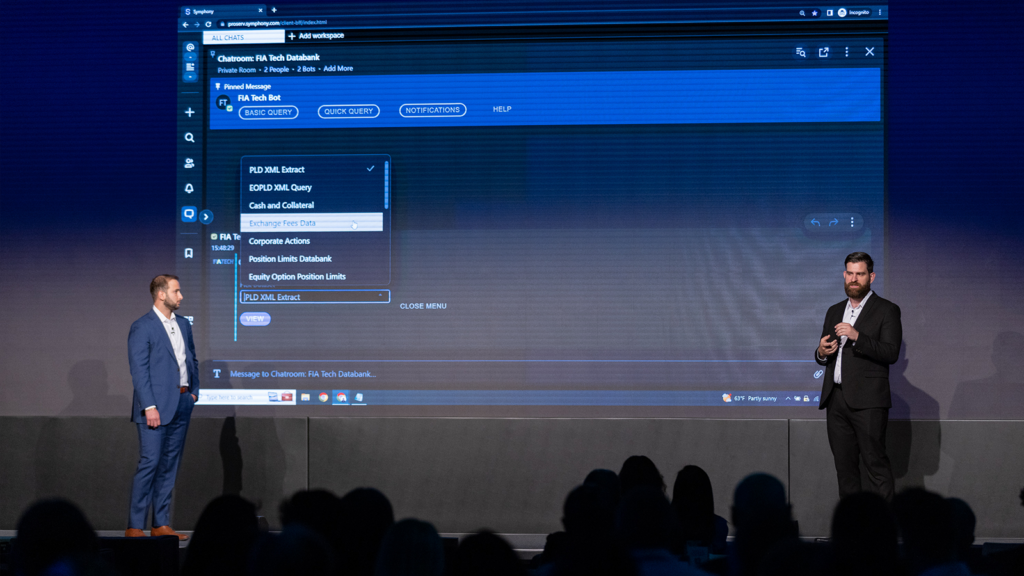

APPS & BOTS

Essential integrations

Save time, reduce email and drive efficiency

CORE CAPABILITIES

Communicate and collaborate securely

Secure bilateral and multilateral real-time chat, file-sharing with built-in security and compliance

Symphony offers encrypted chat-based collaboration to institutions and firms of all sizes, with bots and automation to improve everyday workflows.

Symphony’s strong focus on compliance and encryption dramatically lowers risk and frees up resources your company can use to invest and grow.

RESOURCES